Ready for ILF case study: everwave

everwave snapshot

February 3, 2026

everwave snapshot: Impact-Linked Finance in action in Germany

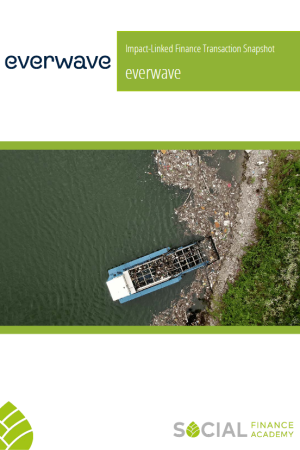

everwave is a Germany-based clean tech enterprise addressing waste pollution in rivers before it reaches the oceans. The enterprise operates river-based waste collection solutions, including boats and barrier systems, to remove waste from waterways in Europe and emerging markets. Due to their innovative Plastic Credits, a perfect case for Impact-Linked Finance!

What you'll learn in this snapshot:

- What everwave does, who its customers are, and which environmental challenges the enterprise addresses

- What the rationale behind the Impact-Linked Finance (ILF) transaction was and who the transaction partners were

- Which impact metrics were chosen by everwave and the transaction partners and how they work

- What everwave CEO and Co-Founder Clemens Feigl says about ILF and its fit with everwave’s business model

Key takeaways from this snapshot:

- everwave is the very first Impact-Linked Finance (ILF) transaction in Germany (under the Ready for Impact-Linked Finance program), structured by Roots of Impact, with support from FASE and investment from the European Social Innovation and Impact Fund (ESIIF).

- everwave’s business model is an excellent fit for ILF, with impact directly embedded through clearly measurable waste-collection activities.

- Readily available impact data highlighted the importance of consistent data collection for target setting and transparent measurement and reporting.

Read the everwave snapshot now!

Read and download the everwave snapshot here!