What is Impact-Linked Finance Readiness?

What is Impact-Linked Finance Readiness?

March 1, 2024

Discover what it means to be ready for Impact-Linked Finance

Do you know what Impact-Linked Finance can do for you as an entrepreneur or as a service provider to entrepreneurs? Do you want to improve your own or your entrepreneur cohort's impact measurement capabilities and increase the chances for receiving this innovative type of finance? In this blogpost, we will fill in you in on the most important things to know.

What is Impact-Linked Finance?

Impact-Linked Finance is all about unleashing the full potential of (impact) enterprises by providing them with “better terms for better impact”. It’s not only about moving money – it’s about making a real difference and supporting lasting, additional impact.

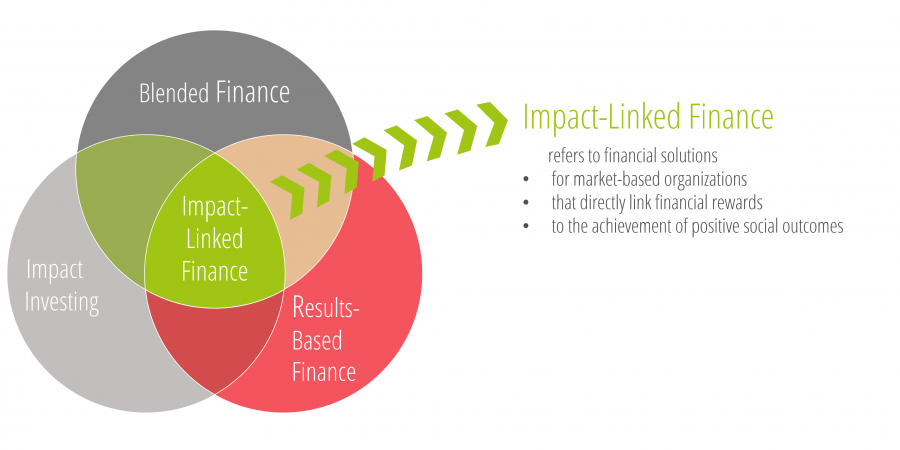

In the definition by pioneer Roots of Impact, “Impact-Linked Finance refers to linking financial rewards for market-based organizations to the achievements of positive social outcomes.” It is an effective way of aligning an enterprise’s positive impact with its economic viability and lies at the intersection between blended finance, impact investing, and results-based finance. For more, read our blog “Impact-Linked Finance explained”.

How to get ready for Impact-Linked Finance

Impact-Linked Finance features an entire toolbox of innovative financing instruments, from Social Impact Incentives (SIINC) to Impact-Linked Loans or the latest addition, Simple Agreement for Future Impact (SAFI). If you would like to know the details of what they can do for an entrepreneur, please check out this cool INNOVATIVE FINANCE TOOLKIT that we helped prepare.

You can also discover the simplicity and agility of SAFI, do a free online COURSE ON IMPACT-LINKED FINANCE ESSENTIALS, or play with our free IMPACT-LINKED FINANCE CALCULATOR that Roots of Impact designed with support from the Swiss Agency for Development & Cooperation.

One message is very important: Since in Impact-Linked Finance, entrepreneurs receive benefits for verified impact, the capacity to do a meaningful IMPACT MEASUREMENT AND MANAGEMENT (IMM) is at the heart of these solutions. Therefore, developing a compelling Theory of Change and establishing a system to define, collect, and analyze relevant impact metrics is a precondition for enterprises to attract Impact-Linked Finance.

Give me examples

Now, what does it exactly mean to be ready for Impact-Linked Finance as an enterprise? The first-of-its-kind Impact-Linked Finance Readiness Bootcamp was developed and run by us for the Biniyog Briddhi (B-Briddhi) program in Bangladesh. It’s an extensive 3-month bootcamp format that we chose for this specific program. We have also run similar BOOTCAMPS for the Impact-Linked Fund for Water, Sanitation & Hygiene (ILF FOR WASH) by our partner Aqua for All. A lighter and shorter bootcamp is being developed for our new READY FOR IMPACT-LINKED FINANCE program in Germany. You can find the first examples ON THIS PAGE.