How to avoid “killer” financing instruments

How to avoid "killer" financing instruments

November 19, 2022

The Good, the Bad and the Ugly: How to avoid the wrong financing instruments

As an impact entrepreneur, looking for capital to scale and not knowing which the “killer” financing instruments are is like risking unwanted bullets in one's chest. To avoid the “valley of death”, there are more questions to ask than just where to find the closest source of water. Here is a short guide through the prairie, with some do’s and dont's for relative greenhorns in impact finance.

What is a "killer" financial instrument?

First, this is what we are trying to avoid:

What is a “killer” financing instrument?

“A „killer” financing instrument kills an impact enterprise’s growth and/or seriously threatens the impact on a scaling journey.”

Or to put the question the other way around: If you had absolutely free choice, which financing instrument would you choose – and why?

- Equity?

- Debt?

- Grants & donations?

- Mezzanine or hybrid?

Here are some important questions to ask yourself before you simply follow the beaten track and go for the “classics” (= equity, grants or debt):

- Which stage is your impact enterprise in and what is the (current/future) legal form that it has/will have (non-profit, for-profit, structural hybrid)?

- How much capital do you really need, how often and for how long? THIS VIDEO from our course can help answer this question.

- Based on your financial forecast, when will you realistically be able to create a surplus – and thus start being in a position to repay the capital – and how quickly?

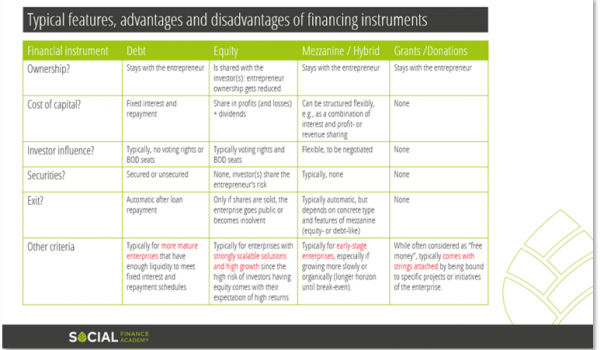

- Do you know the side effects of these financing instruments, such as flexibility, cost, change of ownership structure, influence on your decision-making, additional values and benefits that you can get from your capital providers, or your need and ability to provide securities to your future investors?

- Are you familiar enough with innovative financing instruments and features such as revenue- or profit-sharing agreements or impact incentives that specifically cater to the impact dimension of your enterprise?

If you already know all the answers, feel free to lean back and enjoy your popcorn while watching “The Good, the Bad and the Ugly” movie of impact finance. For everybody else, here is a small guide:

The Good

Like in the movie “The Good, the Bad and the Ugly”, collaboration can be vital to find the gold. Many impact entrepreneurs are quite aware of the traditional financing instruments – debt, equity, grants/donations -, but rather clueless about innovative approaches such as “hybrid” or “blended” finance. “Hybrid or blended” means that you combine different types of capital providers and/or instruments and features in one single financing round. Of course, you can also blend investors and instruments over the lifetime of your venture – many impact entrepreneurs actually do. Here come some examples of great combinations (which of course depend on the concrete case):

- Think about a foundation giving a grant and an impact investor giving a loan. The grant reduces the risk for the investor. At the same time, the loan makes the foundation’s grants more effective because the impact enterprise has a better position to become sustainable and thrive due to the loan.

- Think about a single, patient investor who gives a subordinate, unsecured loan at a much lower interest rate than usual. The investor does this to allow the impact enterprise to focus on developing its business first, instead of paying a lot of interest in the beginning. In order to catch up later on his financial return, the investor receives a fixed share in the enterprise’s profits or revenues until a maximum amount or financial return is achieved. Thus, the (re-)payments to the investor are more aligned with how (slowly or quickly) the impact enterprise’s business develops. This is called a revenue- or profit-sharing agreement.

- Think about a very impact-driven investor. He or she is willing to give a loan at a very low interest rate and combines it with an impact incentive. If the impact enterprise meets certain impact milestones, the investor will receive less interest on the loan. Then, both sides benefit: the investor gets the desired impact and the impact entrepreneur a less expensive financing. This is called Impact-Linked Loan.

- Do you need a good alternative to equity if your enterprise is still in seed stage? If you want to avoid giving away ownership in your company and having to negotiate a valuation way too early in your entrepreneurial journey, then playing it SAFE can be a great alternative. SAFE means Simple Agreement For Future Equity and allows you to avoid the disadvantages of equity while giving the investor the option to convert his or her investment in a future equity round at a discounted price.

Want to know more about innovative finance right away? Then dive into this toolkit!

The Bad

Entering the investor market with “Angel Eyes” is calling for trouble. Not that capital providers have bad intentions – they may simply be very different from yours. Therefore, it is a really bad idea not to know what your options are. Once you secured a specific financing instrument, you have to live with its consequences for quite some time, and it may also influence what is possible in future financing rounds. The chart below gives an easy orientation on some of the main “coordinates” of financing instruments. You can also WATCH THIS GREAT VIDEO from our course.

Want to have a quick overview about what to avoid?

Tip: If you need a very basic orientation, you will find the lecture video “Financing instruments and side effects” in the free “Access to Impact Investment for Social Enterprises” course ON OUR NEWS SFA LEARNING PLATFORM. Bottom line: Spend some time beforehand identifying the major features of different financing instruments. This will definitely pay off later.

The Ugly

It’s not good to be wanted for crime, but to be wanted by investors is an entirely different story – and high on every impact entrepreneur’s agenda. Just make sure to attract the right type of investors and team up with them. One important clue is to first retrieve the vital pieces of information, so you know exactly where to find these investors. In real-life terms, this means first and foremost to research and select investors according to the financing instruments that will serve your journey best. Who exactly provides these instruments in your region and sector? And what are their requirements and expectations? If you have full knowledge of these coordinates, it’s easier to find the gold.

Tip: IN OUR ACCESS To IMPACT INVESTMENT COURSE on our new SFA learning platform there are videos, infographics, and tools about approaching (the right) investors. There is also guidance about how building meaningful investor long- and shortlists that allow you to target the right investors and save tons of time. Bottom line: Once you know exactly what you need (and what you don’t need), it’s so much easier to attract it.

Find a short example of how an investor longlist is built

Do you want to learn more? Go to our course!