Impact-Linked Finance explained

Impact-Linked Finance explained

October 10, 2025

What you need to know about this innovative finance approach

Do you know what Impact-Linked Finance (ILF) can do for you as an entrepreneur or as an investor, funder and network partner? In this blogpost, we will fill in you in on the most important definitions and resources.

What is Impact-Linked Finance?

Impact-Linked Finance (ILF) is all about unleashing the full potential of (impact) enterprises by providing them with “better terms for better impact”. It’s not only about moving money – it’s about making a real difference and supporting lasting impact. Here’s the definition by the ILF pioneer ROOTS OF IMPACT:

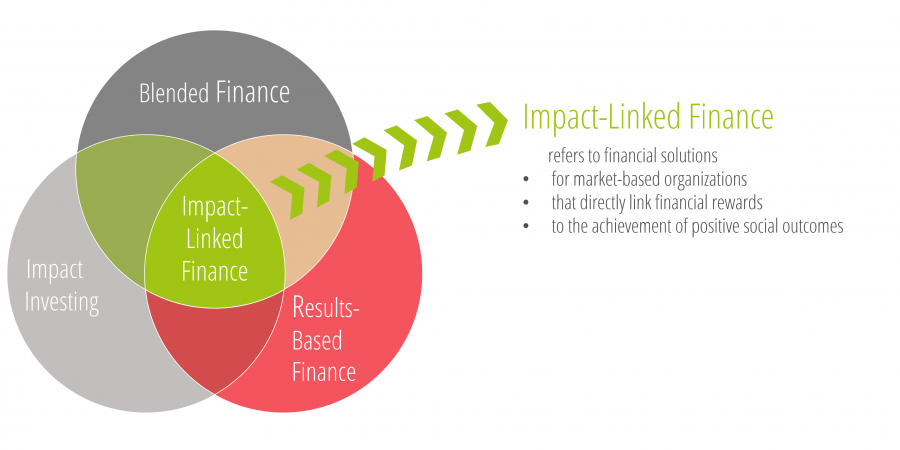

“Impact-Linked Finance refers to linking financial rewards for market-based organizations to the achievements of positive social outcomes.”

It is an effective way of aligning an enterprise’s positive impact with its economic viability. Impact-Linked Finance is an innovative finance approach that lies at the intersection of Blended Finance, Impact Investing, and Results-Based Finance.

For a quick introduction to the philosophy, you can watch A GREAT VIDEO that was prepared by the implementation platform for ILF, the Impact-Linked Finance Fund.

What's in it for impact enterprises?

As explained before, Impact-Linked Finance (ILF) is all about unleashing the full potential of (impact) enterprises by providing them with “better terms for better impact”. The graph below shows, how Impact-Linked Finance strives to create systemic impact in finance:

Which terms related to Impact-Linked Finance are important?

Impact

IMPACT is a change in an outcome caused by an organization. An impact can be positive or negative, intended or unintended. An outcome is the level of well-being experienced by a group of people, or the condition of the natural environment, as a result of an event or action.

THE 5 DIMENSIONS OF IMPACT

The “Impact Management Project” (now available on IMPACT FRONTIERS) convened a practitioner community of over 3,000 enterprises, investors and experts from 2016 to 2018 to build global consensus on how we measure, improve and disclose our positive and negative impacts. It has defined 5 dimensions of impact that enterprises create on people and the planet. These dimensions serve as a great guideline for anyone who wants to understand impact:

(1) What

“What” tells us what outcome the enterprise is contributing to, whether it is positive or negative, and how important the outcome is to stakeholders.

(2) Who

“Who” tells us which stakeholders are experiencing the outcome and how underserved they are in relation to the outcome.

(3) How Much

“How Much” tells us how many stakeholders experienced the outcome, what degree of change they experienced, and how long they experienced the outcome.

(4) Contribution

(5) Risk

“Risk” tells us the likelihood that impact will be different than expected.

Want to know more? DIVE INTO EACH OF THE 5 DIMENSIONS OF IMPACT on Impact Frontiers

Want to know more? DIVE INTO EACH OF THE 5 DIMENSIONS OF IMPACT on Impact Frontiers

Impact Measurement & Management

IMPACT MEASUREMENT & MANAGEMENT (IMM) is similar to the financial management of a business. Yet it aims at measuring and improving the impact of a business on its customers, suppliers, employees and/or society as a whole (in a social and/or environmental context). IMM is the process of identifying the positive and negative impacts that an enterprise has on people and the planet, and then reducing the negative and increasing the positive.

Why do IMM? For an entrepreneur, there are 3 basic benefits of measuring and managing impact:

(1) Knowing you are truly making a difference

Impact entrepreneurs want to prove that their business is really making a difference. They have to bridge their mission with their activities and find a way to accurately measure how efficiently this bridge is functioning – and that is exactly what impact management does.

(2) Long-term business growth and viability

An effective impact strategy is more than just a tick-in-the-box. It’s key to an enterprise’s long-term sustainability and profitability. If entrepreneurs truly listen to the needs of their stakeholders and modify their product/services accordingly, they can improve the performance of their businesses. Therefore, impact management is a crucial element in decision-making because data collected from impact measurement can provide a signal to what works and what doesn’t work on various aspects of business operations.

(3) Accountability to your stakeholders

Entrepreneurs want to show their stakeholders that they matter to them and that they can trust their businesses. By embedding impact management, entrepreneurs signal to stakeholders that they care about the positive and negative impact they have on them and that they are willing to be held accountable for their actions. This transparency offers an alternative, yet very powerful approach to measuring the success of a business and increasing stakeholders’ engagement.

Need more convincing? Read the ABC OF ENTERPRISE IMPACT on Impact Frontiers.

Want to dive deeper? DIVE INTO OUR IMM TOOLKIT which was co-created with several partners for the B-Briddhi program.

Want to dive deeper? DIVE INTO OUR IMM TOOLKIT which was co-created with several partners for the B-Briddhi program.

Theory of Change

In impact measurement & management, a clear definition of the problem should be followed by a plan of how to solve it. A useful tool to help businesses set up a strategy is the THEORY OF CHANGE (ToC).

A ToC explicitly outlines how a business will make an impact on the targeted community. It does so either in the form of a written text or a visual map. We think it is best to include stakeholders in this process because in the end, people (such as employees, users, or funders) are the ones that are affected by the business activities. To help entrepreneurs correctly set up the ToC, a step-by-step process is helpful:

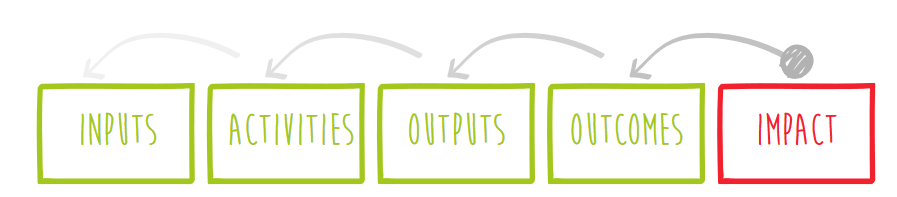

(1) The first step is to define an impact goal. An impact goal is what an enterprise wants to achieve and can contribute, based on the part of the bigger problem it has decided to tackle. In doing so, the enterprise will make sure that it stays on the right track and maintains its purpose.

(2) Once the impact goal is defined, entrepreneurs work backwards. Together with their stakeholders, they will come up with the intended short-term and long-term results required to achieve the impact goal. We call these outcomes: changes, benefits, learnings, or other effects that result from their activities.

(3) Next, enterprises need to consider the outputs, which are the products or services directly produced by their activities. Typically, the provision of outputs is under the control of the enterprise.

(4) To make changes happen, a business has to perform certain activities. These are concrete day-to-day tasks it must undertake to effectively provide a product or service. Each output should be linked at least to one activity. Just like outputs, activities should be controlled by the enterprise.

(5) Lastly, enterprises should create a list of resources needed to perform the activities. We call them inputs and they relate to all kinds of resources, whether capital or human.

Any good theory rests on well-documented assumptions, both implicit and explicit, which state the way we see the world. The same holds for a ToC. For an enterprise to have a credible ToC, it needs to make realistic assumptions about the links created between activities and outputs, outputs and outcomes, and outcomes and impact goals.

Want to dive deeper? GOT TO OUR IMM TOOLKIT co-created with our partners in the B-Briddhi program.

Want to dive deeper? GOT TO OUR IMM TOOLKIT co-created with our partners in the B-Briddhi program.

Impact Enterprise

The term IMPACT ENTERPRISE refers to a spectrum of enterprises that deliver social and/or environmental impact in a financially self-sustainable way.

Since many countries and ecosystems have their different (sometimes legal) definitions and understandings of enterprises that (primarily) pursue the creation of positive impact, we chose to use the term “impact enterprise” as defined above since we want to be inclusive and mindful of the many variations across the globe.

Therefore, for us at the Social Finance Academy, an impact enterprise doesn’t need to have a specific legal form to qualify as such. In general, an impact enterprise can be organized as a for-profit legal entity (for example a limited), as a non-profit legal entity (for example a foundation) or as a combination of both (“structural hybrid”). Again, legal forms vary a lot around the world. Some countries have even created new legal forms that cater specifically to enterprises that are pursuing measurable positive impact and are providing solutions to pressing social and/or environmental challenges.

One important facet for us, however, is that impact enterprises need to strive to be financially self-sustainable. This entails that they are generating revenues. Such revenues can either come from selling products and services directly to customers and beneficiaries, or indirectly, for example by selling to a governmental body which then delivers these products or services to the ultimate beneficiaries.

As a result, many impact enterprises are generally able to attract repayable capital and don’t survive on “free money” = grants/donations alone. Their ability to become financially self-sustainable is also the precondition to attract impact investors and make use of the multitude of innovative finance instruments.

Want to dive deeper? READ THIS GUIDE TO IMPACT ENTERPRISE from Griffith University.

Want to dive deeper? READ THIS GUIDE TO IMPACT ENTERPRISE from Griffith University.

Impact Investing

IMPACT INVESTING is an investment philosophy that makes the impact part of any investment activity. According to the Global Impact Investing Network (GIIN), “impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return”.

MAIN FEATURES

(1) Intentionality: An investor’s intention to have a positive social or environmental impact through his or her investments is essential to impact investing. This intentionality is typically demonstrated by how serious an investor is about measuring and managing the investee’s as well as his or her own impact.

(2) Return expectations: Impact investments are expected to generate a positive financial return on capital for the investor. At a minimum, this has to be a full return of the capital invested. Put differently: impact investments are repayable forms of capital. Grants and donations, sometimes called “free money” by impact entrepreneurs, don’t fare under impact investments. However, they may be one component in an innovative (impact) finance model.

(3) Return expectations: Impact investments target financial returns that range from below market (sometimes called “concessionary”) to risk-adjusted market rate. The term “risk-adjusted market rate of return” depicts the return that the market (=the sum of investors) typically accepts as the standard for an investment with the same risk profile. For impact enterprises, in specific, this often means that market-rate-seeking impact investors expect the same returns from them as traditional, non-impact enterprises with the same risk profile create. Below-market or concessional impact investors, however, prioritize impact and are ready to accept (much) lower returns, if necessary.

(4) Impact measurement and management: A hallmark of impact investing is the commitment of the investor to measure and report the social and environmental performance and progress of his or her investments. This ensures the necessary transparency and accountability. At the same time, this also sets an example to inform the practice of impact investing and build out this new and still relatively nascent investment philosophy across the globe. Put differently: If an investor calls him- or herself an “impact investor” but doesn’t measure and manage the impact of his investees, this is a clear indication that the label doesn’t match the reality.

Want to dive deeper? STUDY THE RESOURCES BY THE GIIN.

Want to dive deeper? STUDY THE RESOURCES BY THE GIIN.

Types of Impact Investors

IMPACT INVESTORS can be differentiated in many ways. Here are just a few options to group them:

By risk-return-impact profile

Different impact investors pursue different risk-return-impact expectations when they engage with impact enterprises or any other type of target investees (e.g. impact funds). In essence, there are two types: (1) Investors who defined positive and measurable impact as their top priority and are willing to accept lower financial returns for higher impact (if necessary). They are called “impact-first impact investors” or “investors FOR impact”. (2) The second group are investors who clearly prioritize financial returns while still wanting to achieve positive impact. They are typically expecting risk-adjusted (near) market-rate returns (or above) from their target investees. These investors are called “financial-first impact investors” or “investors WITH impact”.

By impact sector

In the growing impact investment market, there are many impact sectors that different investors are focusing on. For an impact enterprise, it is wise to check up-front which sectors are prioritized by specific investors, before approaching them for a potential investment. Typical sectors are sustainable/regenerative agriculture, renewable energy, conservation, microfinance, affordable and accessible basic services such as housing, healthcare, and education, or sectors such as water, hygiene and sanitation (WASH). Sector trends and preferences may change over time, with the effect that some impact sectors attract much more capital than others.

By source of capital

In general, impact investors can be private/individual investors who invest their own money or institutional investors who have the mandate to manage other people’s capital.

Typical private investors are business angels, also called “angel investors”, or high-net-worth individuals/wealth owners. Typical institutional investors are (impact) fund managers, impact VCs, development finance institutions (DFIs), financial institutions, banks, foundations, pension funds, insurance companies, family offices, religious institutions (also called “faith-based investors”) or corporates.

Want to dive deeper? STUDY THE RESOURCES BY THE GIIN.

Want to dive deeper? STUDY THE RESOURCES BY THE GIIN.

Innovative Finance

INNOVATIVE (IMPACT) FINANCE is an umbrella term comprising an increasingly wide range of non-traditional financing instruments and mechanisms that aim to mobilize additional funds for development and impact projects. Among others, these projects can take the form of micro-finance/-contributions, public-private partnerships or market-based financial transactions (such as investments in impact enterprises).

It’s easy to get lost in the alphabet soup of ever-emerging innovative finance instruments, models and structures. Yet some common denominators are:

They support scaling and capital mobilization: Innovative Finance is meant to increase the flow of capital towards the Sustainable Development Goals (SDGs) and to bridge the huge financing gap (in the size of several trillion US$) to achieve these SDGs.

They strive to ensure financial and impact additionality: Since Innovative Finance was created to fill the huge SDG financing gap, it strives to “make happen what wouldn’t have happened anyway”. Innovative Finance is all about mobilizing capital BEYOND the funding that is already invested in development and impact projects (= financial additionality). Innovative (Impact) Finance also tries to push the boundaries by creating more, deeper and/or broader impact (= impact additionality). To summarize: It’s not only about mobilizing more money, but also about using it in a smarter way by generating more impact.

They have the objective to foster sustainability: In order to have a significant and sustainable impact on the SDGs, Innovative Finance needs to think longer-term and enable the target development and impact projects to become financially self-sustaining. In the context of impact enterprises, this means that Innovative Finance should enable the enterprise to reach financial breakeven and scale its impact, rather than being just a short-term financial injection that loses its effect within a short time.

There are many Innovative Finance instruments that cater to the specific needs of impact enterprises and can mobilize more capital to finance these. Examples are Impact-Linked Finance instruments (for market-based organizations), Results-Based Finance instruments (for non-profit organizations) or other catalytic financing instruments such as subordinated loans, first-loss capital or guarantees.

Want to dive deeper? CHECK OUT OUR INNOVATIVE FINANCE TOOLKIT co-created with Roots of Impact, LightCastle Partners and many other experts.

Want to dive deeper? CHECK OUT OUR INNOVATIVE FINANCE TOOLKIT co-created with Roots of Impact, LightCastle Partners and many other experts.

Impact-Linked Finance

IMPACT-LINKED FINANCE is all about unleashing the full potential of (impact) enterprises by providing better terms for better impact.

Impact-Linked Finance refers to linking financial rewards for market-based organizations to the achievements of positive social outcomes. It is an effective way of aligning positive impact with economic viability. Impact-Linked Finance lies at the intersection between Blended Finance, Impact Investing and Results-Based Finance and shares specific features with each of these 3 practices.

Our parent organization, ROOTS OF IMPACT, is a pioneer in this innovative practice and has defined it together with the Boston Consulting Group (BCG) in 2019. The bigger mission behind it is to re-invent finance by making impact an integral part of any investment or transaction. Also, Impact-Linked Finance is directly rewarding the value creator on the ground, typically the impact enterprise, for the verified impact it has created. Depending on the exact Impact-Linked Finance instrument, – for example, Social Impact Incentives, Impact-Linked Loans or SAFI -, this reward comes in the form of extra payments or cheaper financing costs.

There is a lot to know about the benefits and suitability of Impact-Linked Finance, especially the DESIGN PRINCIPLES FOR IMPACT-LINKED FINANCE.

Want to dive deeper? The most comprehensive source of knowledge for any level, whether beginner or expert, is the KNOWLEDGE CENTER FOR IMPACT-LINKED FINANCE, created by Roots of Impact and iGravity and sponsored by the Swiss Agency for Development and Cooperation (SDC).

Want to dive deeper? The most comprehensive source of knowledge for any level, whether beginner or expert, is the KNOWLEDGE CENTER FOR IMPACT-LINKED FINANCE, created by Roots of Impact and iGravity and sponsored by the Swiss Agency for Development and Cooperation (SDC).

Blended Finance

According to Convergence (the global network for blended finance practitioners), BLENDED FINANCE is “the use of catalytic capital from public or philanthropic sources to increase private sector investment in developing countries to realize the SDGs”.

Blended finance is a structuring approach for combining different types of finance from different sources. The main 3 stakeholders in blended finance structures are therefore (1) catalytic or concessional capital providers (e.g. development agencies, foundations), (2) commercial capital providers such as (impact) investors, and (3) the recipient of capital, which, for example, can be one or several impact enterprises or a big development project.

Despite its numerous combinations and structures, blended finance should always have three distinctive characteristics:

(1) Catalytic effect (i.e. mobilizing additional capital)

(2) Contribution towards achieving the SDGs

(3) An expected positive financial return for all capital providers involved

Catalytic capital differs from commercial capital insofar as it typically bears higher risk and/or seeks lower returns. This “concessionality” is what makes it catalytic and allows for the mobilisation of additional investment. Typical catalytic capital providers are funders that seek impact above all else, e.g. public funders such as development agencies or private or corporate foundations.

How blended finance works:

Investors from the private sector (e.g. impact investors) are generally looking for an appropriate return for the level of risk of an investment, i.e. a “risk-adjusted” return. The higher the (perceived) risk, the higher the expected return needs to be to compensate for that risk. For projects or enterprises that are not meeting the risk-return expectations of these investors, there are two basic ways for catalytic capital providers to attract them (with possible combinations of both):

(A) By de-risking the investment: reducing the risk for the investor(s)

(B) By return enhancement: increasing the return for the investor(s)

Want to dive deeper? STUDY OUR INNNOVATIVE FINANCE TOOLKIT co-created with Roots of Impact, LightCastle Partners and other experts, or visit the website of CONVERGENCE for the latest data and insights on blended finance across the globe.

Want to dive deeper? STUDY OUR INNNOVATIVE FINANCE TOOLKIT co-created with Roots of Impact, LightCastle Partners and other experts, or visit the website of CONVERGENCE for the latest data and insights on blended finance across the globe.

Results-Based Finance

RESULTS-BASED FINANCE (RBF) is a broad term that refers to all the instruments that provide funding upon achievement of specific results. Given the expansiveness of the definition, RBF entails a broad spectrum of interpretations and applications such as:

- performance-based contracts

- impact bonds

- advance market commitments

- and other financial rewards.

The essential aim of the RBF approach, which has been used in development finance for decades, is to provide and encourage more efficient and effective use of public funding and implementation capacity towards achieving the SDGs.

Want to dive deeper? GOT TO THE RBF PAGE of the Global Partnership for Results-Based Approaches (GPRBA)

Want to dive deeper? GOT TO THE RBF PAGE of the Global Partnership for Results-Based Approaches (GPRBA)